Time for a wealth tax?

Plus: Spring Statement, the cost of taxes and regulation, and killjoys

In today’s newsletter:

Why wealth taxes won’t work

Nominal GDP targeting

Has the Chancellor done enough?

and more….

Wealth taxes used to be a fairly common form of taxation. In the mid-1990s, 12 OECD countries still had wealth taxes of one kind or another.

They have since fallen out of favour. All but three of those countries have since given up on them.

In recent months, though, the idea has experienced a major revival. Its most vocal proponent, the economist and former city trader Gary Stevenson, has built up a cult following around it. Of course, all the usual suspects from the Corbynite Left have also joined it.

As is often the case with these people, they show no interest whatsoever in how their ideas have turned out in practice so far: they only talk about them in the form of moral values and lofty ambitions. Even if they acknowledge that previous attempts to implement wealth taxes have been disappointing, these activists are convinced that next time will be different somehow.

But wealth taxes have been abandoned for good reason. Experience shows that they raise little revenue while imposing high administrative and compliance costs. Wealth has to be estimated with complex valuation methods, and these estimates have to be constantly revised.

Wealth taxes also lead to capital flight and suppress wealth formation, thereby eroding their own base over time.

However, in a stagnant economy with a housing affordability crisis, there will always be an audience for bad economic ideas. For free-marketeers, it is therefore not good enough to criticise wealth tax proposals in isolation. We also need to address the economic context which creates the demand for such proposals in the first place. Tough on bad economics, tough on the causes of bad economics.

Kristian Niemietz

Editorial Director

P.S. The best way to never miss out on IEA work, get access to exclusive content, and support our research and educational programmes is to become a paid IEA Insider. For a limited time only new paid subscribers will also receive a copy of Dr Steve Davies’ book Apocalypse Next: The Economics of Global Catastrophic Risks for free.

IEA Podcast: Executive Director Tom Clougherty, Editorial Director Kristian Niemietz, and Director of Communications Callum Price discuss the Spring Statement, tariffs, steel, and wealth taxes, IEA YouTube

Sluggish growth demonstrates need for more fundamental reform

Responding to the Spring Statement, Tom Clougherty, Executive Director said:

“The Chancellor is right to cut spending rather than raise taxes again, and the cuts she has made are welcome. There is, nevertheless, a sense of unreality about all this. Policy is being determined by an arbitrary, moving target – a fiscal rule – rather than with any long term, principled strategy in mind.

“When you look at the sluggish growth forecasts, and the enormous liabilities the state will encounter as the population ages, Britain’s cycle of fiscal events feels a lot like rearranging the deck chairs on the Titanic.

“Turning increased defence spending into an exercise in ‘modern industrial strategy’ suggests that the government still has too state-centric a view of economic growth – one that is almost certain to disappoint in the long-run.

“Ultimately, we are going to need much more fundamental reform – going further and faster on the deregulatory, supply-side measures the government has begun to talk about; lifting the self-defeating burdens that have been imposed on business; and taking a long, hard look at what the state does and how it is funded.”

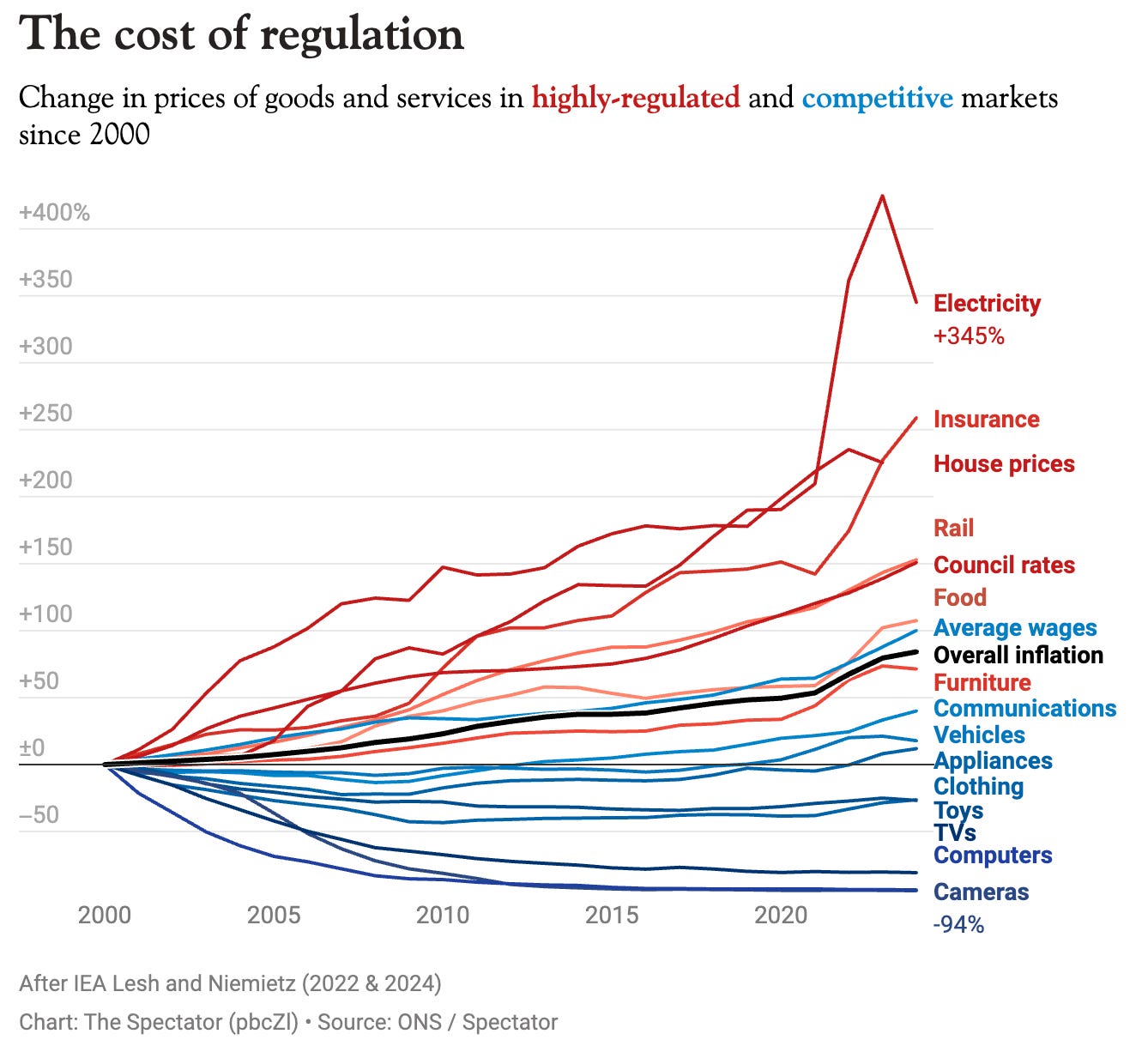

On housing regulation, Kristian Niemietz, Editorial Director said:

“While the Spring Statement was overshadowed by the bad news of downgraded growth forecasts, there are also some silver linings hidden in the OBR report which the Chancellor alluded to. In particular, the government’s planning reforms are projected to lead to a 0.5% increase in the housing stock by the end of this decade, which, in turn, is projected to lead to a 0.2% increase in GDP. 0.2% may not sound like much, but it is rather a lot if we bear in mind that this represents a pure gain, which comes at no cost and with no downsides. It is the equivalent of finding a pile of pound notes worth 0.2% of your annual salary lying around on the pavement: you would not feel like you had just won the lottery, but you would certainly pick them up.

“0.2% is just the direct, medium-term effect. The OBR also point out that if increased housebuilding leads to more people moving to high-productivity areas, the long-term growth effect would be higher still. This should raise the following question: if it is so easy to add 0.2% to GDP just with a fairly modest regulatory reform, why not repeat that exercise on a much bigger scale?”

On the welfare measures, Professor Len Shackleton, Editorial and Research Fellow said:

“The much-publicised benefit savings of £4.8 billion will be offset by extra spending on implementing this – more staff, presumably, to screen claimants. The problem is that the new spending is real while the savings are projections which may not be achieved, meaning the net savings of £3.4 billion may be fanciful.”

Responding to the statement, Julian Jessop, Economics Fellow said:

“This is not a ‘return to austerity’. The £14bn of savings on current spending is just a drop in the ocean: public sector current spending is still forecast to climb to £1,351bn in 2029-30, £219bn more than in 2024-25.“Moreover, most of the announced savings will come from efficiency gains in public services where productivity has lagged well behind, and from cutting some benefits paid to people who may not actually need them. Again, this is hardly ‘austerity’.

“Nonetheless, the late scramble to find additional savings on the welfare bill – simply to restore exactly £9.9bn of fiscal headroom – does raise the risk that some vulnerable people will lose out. Making such big decisions on the basis of spuriously precise forecasts is not a sensible approach.

“Indeed, the Spring Statement illustrates both the strengths and weaknesses of the UK’s current fiscal framework and the role of the OBR. On the plus side, the independent watchdog is reported to have rejected dubious costings produced by the government as recently as last week. However, this has prompted a last-minute rush to hit fiscal targets based on five-year forecasts which will almost inevitably be proved wrong.

“The room for error is also still incredibly limited. As the OBR itself has pointed out, the fiscal headroom is the third lowest any Chancellor has had against their rules, and could easily be wiped out by new shocks, including higher interest rates and a global trade war. There is no guarantee either that public sector productivity can catch up without fundamental reforms that will be resisted at every stage.

“There is therefore a high chance that the Chancellor will have to come back again with additional tax increases and more painful spending cuts as soon as the Autumn Budget.”

See the full analysis on IEA Insider:

NEW PUBLICATION: Rethinking Monetary Policy

The case for adopting NGDP targeting in Britain

Inflation targeting fails to distinguish between demand and supply-side driven inflation, leading to suboptimal policy responses and delayed recovery from financial crises, such as the Covid-19 pandemic and 2008 financial crash.

Targeting the growth path of nominal GDP would provide a more stable macroeconomic environment, reduce policy uncertainty, and help to restore confidence in the Bank of England following post-Covid inflation.

The Government should consider updating the Bank of England’s mandate, replacing today’s inflation target with a new framework based on nominal GDP – or, in layman’s terms, total spending in the economy.

Read author Damian Pudner’s piece in The Spectator

Watch communications Manager Reem Ibrahim discuss with Damian Pudner, IEA YouTube

News and Views

Analysis by Policy Engine for the Institute of Economic Affairs illustrated how the average cost of the coming tax rises on households will exceed £1,000 per year – and made the front page of the Daily Mail

Read the full analysis here:

Research by Public Policy Fellow Matthew Lesh was covered in The Spectator’s economics column ahead of the Spring Statement

“A serious rethink of Britain’s regulatory regime – in planning, digital technology, and crucially energy – could offer the kind of breakthrough Bailey believes only AI can deliver. Reeves won’t go there today, but she may soon find that a major pivot on regulation becomes impossible to avoid.”

Tom Clougherty made the case against retaliatory tariffs, BBC 5 Live

Reem Ibrahim was on BBC 2’s Politics Live ahead of the Spring Statement

Tom Clougherty criticised the Government’s stealth taxes, Daily Mail

“It is very dishonest to raise revenue in this way while claiming you will not raise taxes on working people”

Callum Price argued that the Government should be bold when it comes to Civil Service reform, The Telegraph

“Cutting the Civil Service even by as much as 100,000 would only take it to the level it was six years ago,” added Mr Price.

“The Government should consider Civil Service reform through this lens, and be bold. Growth is rightly the Government’s priority, and it is clear more officials does not equal more growth.

“[Sir Keir] Starmer and Reeves should shrink the size of the state and the Civil Service with it, and let business and the private sector drive the economy.”

Reem Ibrahim argues in that the Chancellor’s plan won’t touch the sides, Daily Express

“[W]orking people deserve to keep more of what they earn, rather than have it squandered by a bloated and inefficient state. The Government must go so much further in reducing public spending. We shouldn’t be trimming the fat, but instead be putting the Government on a high dose of ozempic.”

Kristian, bad economics is where we are now as a result of poor decisions made by successive governments for decades. All decisions have been made because of misunderstandings and misconceptions. One of which is the common belief that people who have income tax deducted from their wage packets are the main tax payers! That is not a true statement nor should it be. The rich by definition should carry the most burden and although the richest people and companies pay an awful lot of tax revenue it’s still not enough as our government can’t balance the books so all tax revenue is insufficient. That has been the same position for a very long time, in fact since at least 1815 when borrowing began for the Napoleonic war and we have been stuck with a national debt ever since! But in recent times our national debt has become astronomical and totally unrealistic all because the system allows the rich to be richer at the cost of the poor becoming poorer. The poor now are the middle classes of workers who struggle to pay their monthly costs and spend all their income as a necessity. Also, the expectation of economic growth from a deficit on a stagnant economy that’s spiralling downwards is just delusional. We owe now £2,800,000,000,000.00 trillion, how can we grow from that minus position? Also the word investment is used as a magic wand to growth, but is that possible? In z word no! Not with the hope and see policy adopted by the exchequer on investment. The hope the rich will invest if it’s in their interest maybe but, they just makes them richer! And the cost is bourn by the rest of us as we get poorer. So do we need more tax revenue? Of course we do! But we have a system of no cohesion or direction. Cutting benefits to the disabled is so ignorant and Juvenal, it’s the sort of piggybank economics we learn as a child. If you can’t put money in then stop taking money out of the bank! Well that’s not good enough for an economy! We expect and need better thinking than that. We haven’t had any proper thinking Chancellor for centuries it seems! The basics are not understood even by the glitterati of the economic world! For example, “we the taxpayer” what a misunderstood term. All seem to think the employees pay income tax? No! It’s the employers who pay it! The problem there is the employee can’t enjoy spending it first! They work hard, then have it deducted so there is no enjoyment through benefitting from it! And the finger wagers who complain and spout “we the taxpayer” are not the ones who have to pay it, as they never get it! Most tax is collected in other ways through SPENDING the money! As the employers spend on employees then income tax and NI is triggered snd paid. As does employees spending their money on food goods and services Vat, Duty and tax on money having to move by spending like in council tax. So the rule here is tax is triggered by money moving or having to move via spending. The difference between the poor snd the rich is that rule. The poor have to spend all their money and the rich don’t! And the poor have to spend it in a cycle of say a month and the rich don’t! They can hang on to it for days weeks months years decades and centuries snd their lays the rub. We are devoid of it for short times (recessions) and long times (depressions). The rich get richer while the poor get poorer. Now this is an overview but it’s still correct! Our working pot that generates tax revenue by spending is devoid of the vast sums held by the rich unspent and unused but more importantly untaxed! If money revolves through the actual economy it would produce tax bus spending on an exponential basis and produce many times more tax revenue for the same money than just a tax once direct to the exchequer by way of say an income tax or a direct wealth tax! That money needs to revolve around our pot! And at present it’s not! For example, the money we borrow as a nation must be borrowed by definition from those who have it! Not from those who don’t. Have it. And guess what, even if you did tax them they would still earn interest and just recover that wealth tax payment! No it’s a complete hash up. No matter what the government do to cut spending or put up interest rates or take money from the poor it means a downward tax take! So what do we do? Well thanks to Brexit we can reintroduce exchange control regulations. To keep all our money here! If millionaires want to go abroad then let them but they can’t take their money! Money is for an exchange of work. Not to steel away snd hoard. The system couldn’t be policed for millennia but we can now with computer accounts and bank cards. Make all money move and force it to be spent or get it taken! It’ll certainly force people to spend! But it also ensures a rotation of money through our economy like a tsunami. And stop income tax. Rely on vat alone. Let everyone earn as much as they can. But make them spend it! Happiness will return rather than poverty! The rich ironically will earn more and more often so they can be richer from the stuff they buy! Not by hoarding. And we will not have to borrow as a nation as we will have sufficient Vat take to cover all needs! It really is that simple! We all need rainy day money but honestly it’s got ridiculous. We would all earn more and benefits can increase not decrease! We need a spending policy! It’s that simple. Not a wealth tax but, an autonomous perpetual system of spending not hoarding.