Bank of England wrong to not cut rates

There is more to monetary policy than just setting interest rates

By Economics Fellow Julian Jessop

Many people were baffled by the Bank of England’s decision to keep interest rates at 5.25% last week, despite the return of inflation to the 2% target. Some have even accused the Monetary Policy Committee of political bias. Others have merely charged the MPC with incompetence. Neither accusation is justified, but the Bank should never be above criticism.

It is not unreasonable to argue that inflation needs to remain around 2%, not just hit the target in one single month, and that it is still expected to rise again later in the year. The Bank now also expects the UK economy to grow by 0.5% in the second quarter of the year, on top of the 0.6% expansion in the first quarter. With growth back on track, it might make more sense to keep policy tighter for longer to continue bearing down on inflation.

However, there is already plenty of evidence that underlying cost and wage pressures are easing. Interest rates are now even higher than they need to be, the full effects of past increases have yet to feed through, and the recovery is partly based on hopes that the Bank will cut rates. The longer the Bank waits, the greater the risks that inflation undershoots the target, while unnecessarily holding back growth as well.

More generally, though, a narrow focus on the level of interest rates may be missing the bigger picture. The IEA has just published a new book by Tim Congdon which explains how most economists and central bankers failed to predict the surge in inflation over the last few years because they overlooked what was happening to the money supply.

The good news here is that broad money growth has picked up recently, which suggests that the risks of either stagflation or deflation have receded. But the Bank has still to recognise that the rapid expansion of the money supply in 2020 – under the guise of ‘Quantitative Easing’ – provided the fuel for the subsequent cost-of-living crisis. In short, monetary policy still needs to be about the quantity of money, not just the price.

IEA: Bank of England wrong to not cut rates, Julian Jessop quoted in The Guardian, The Daily Mail, The Daily Telegraph & The Intermediary

If you want to support the IEA’s charitable mission, our offer to new subscribers (which includes a copy of Steve Davies’ new book Apocalypse Next: The Economics of Global Catastrophic Risks) is still available:

New book reveals why economists and central bankers failed to predict the cost of living crisis

Leading economist Professor Tim Congdon calls for a shift in the Bank of England’s approach to controlling inflation.

Most economists failed to anticipate the high inflation in 2022 following the Covid-19 pandemic. This resulted in a delayed response from the Bank of England in the United Kingdom and the Federal Reserve in the United States.

A handful of economists correctly predicted the inflationary threat as early as June 2020 by monitoring the growth in the money supply.

As measured by ‘Broad Money’, the money supply grew by over 15% between February 2020 and February 2021.

The Bank of England should focus on ‘Broad Money’ — a measure of money including virtually all bank deposits — to control inflation.

What's Causing Inflation? Quantity Theory of Money Explained, Communications Officer & Linda Whetstone Scholar Reem Ibrahim, IEA YouTube

News, Views & Upcoming Events

Doctors campaign for drink-drive limit to be lowered to one beer, Head of Lifestyle Economics Christopher Snowdon, The Times, The Daily Mail, LBC, The Drinks Business

Election 2024: Unpacking Party Manifestos | IEA Podcast, Executive Director Tom Clougherty, Director of Public Policy & Communications Matthew Lesh & Editorial Director Kristian Niemietz, IEA YouTube

The low-energy election: What the party manifestos have to say on energy and climate change, Energy Analyst Andy Mayer, IEA Insider

The Myth of America's Free Market Healthcare | IEA Book Club, Tom Clougherty interviews Cato Institute Director of Health Policy Studies Michael F. Cannon, IEA YouTube

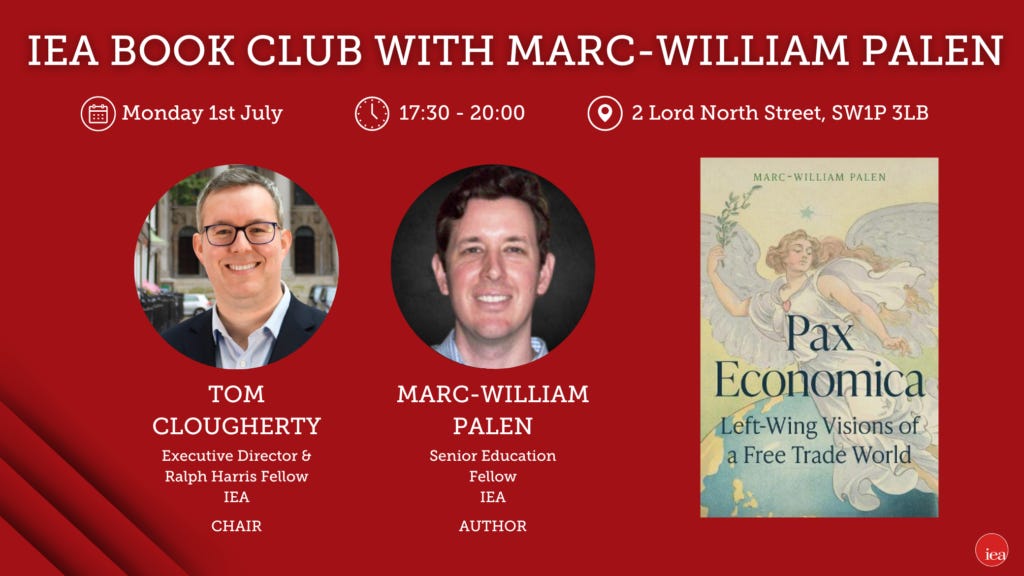

Join us for our next Book Club event with University of Exeter historian Marc-William Palen to discuss his new book, Pax Economica: Left-Wing Visions of a Free Trade World.

Marc-William is a historian at the University of Exeter. His new book, Pax Economica: Left-Wing Visions of a Free Trade World (Princeton University Press), was published in April in the UK, and has been named among the year’s ‘best books’ by the New Yorker. His other publications include The ‘Conspiracy’ of Free Trade: The Anglo-American Struggle over Empire and Economic Globalisation, 1846-1896 (Cambridge University Press, 2016). He is co-director of History & Policy’s Global Economics and History Forum in London. His work has also appeared in Le Monde, Time Magazine, the Washington Post, the Australian, and the New York Times.

Join the next Economic Affairs research workshop in Madrid this December. The workshop gives scholars a unique opportunity to discuss the process of writing and publishing papers in academic journals.

Location: Universidad Francisco Marroquín, Madrid, Calle de Arturo Soria, 245, 28033 Madrid, Spain.

Date: December 13-14, 2024

Education co-ordinator Megi Cara has arranged a meeting for anybody interested in studying the University of Buckingham's online MA in Political Economy by Research. Run by Editorial & Research Fellow Professor Len Shackleton and Vinson Centre Director Dr Juan Castaneda, the course is for students with a strong interest in the history of economic ideas and the application of economics to questions of public policy.

Date: 11th July

Time: 5:30 - 6:30

Location: 2 Lord North Street, SW1P 3LB