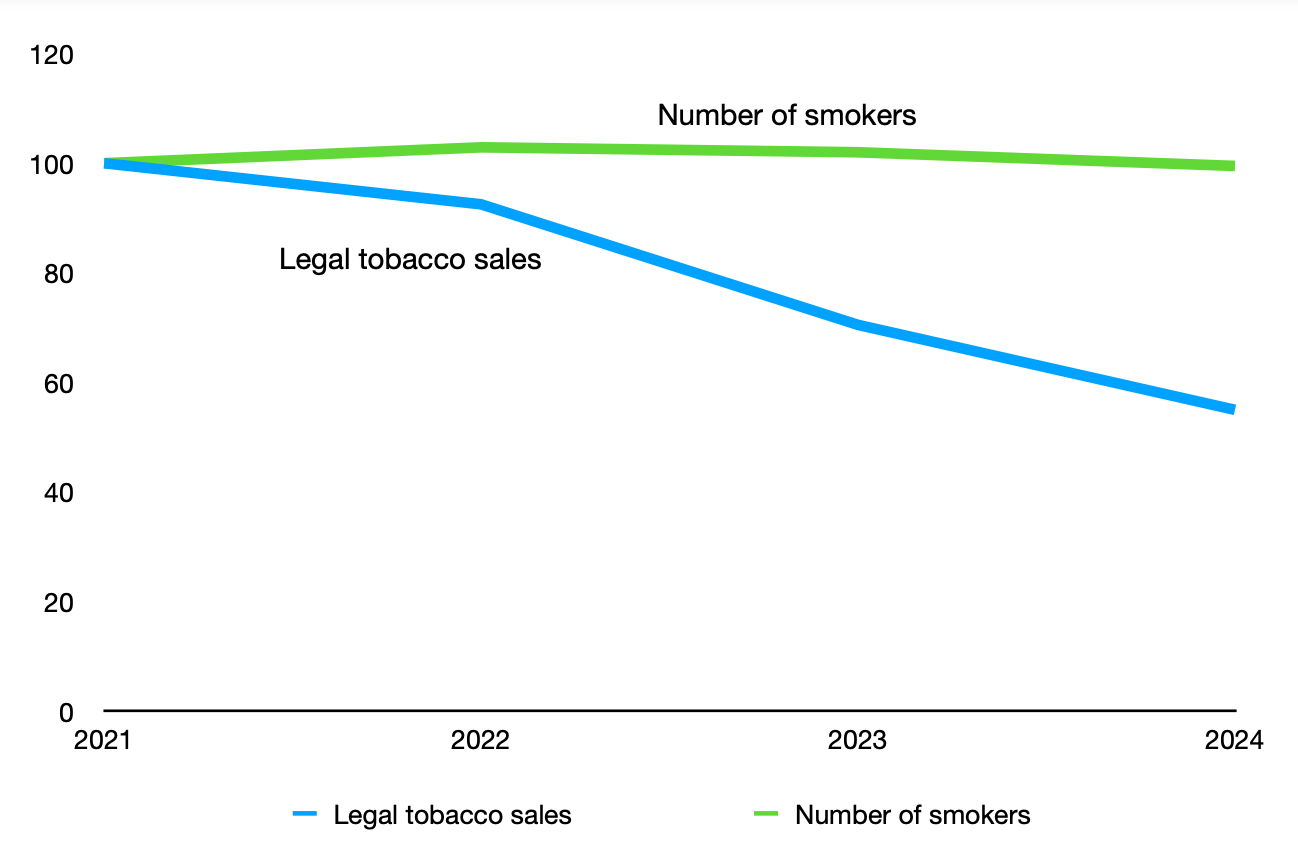

Official figures recently published by HMRC indicate a huge rise in illicit tobacco sales in the UK since 2021. The number of duty-paid cigarettes sold plummeted from 23.6 billion in 2021 to 13.2 billion in 2024, a decline of 44.4%. In the same period, sales of duty-paid hand rolling tobacco (HRT) have dropped from 8.6 million kilograms to 4.5 million kilograms, a decline of 47.6%. Overall, the number of cigarettes bought on the legal market fell by 45.5% between 2021 and 2024.

This unprecedented decline in legal tobacco sales occurred despite the number of smokers falling only modestly. When population growth is taken into account, the number of smokers declined by just 0.5 percentage points between 2021 and 2024, a relative decline of 5%. Nor can the decline in legal sales be explained by smokers consuming fewer cigarettes. Research published last year found that daily cigarette consumption has remained stable since 2020 at around 10.5 cigarettes per smoker on average.

The graph below shows the changes in the number of smokers and the amount of tobacco sold legally in the UK since 2021. Smoking prevalence figures for 2024 have not yet been released by the Office for National Statistics. In their absence, we can use data from the Smoking Toolkit Study which surveys 1,700-1,800 adults every month to produce estimates of smoking in England, Scotland and Wales. In England, the average smoking prevalence estimate in 2021 was 14.7%, falling to 14.2% in 2024. Extrapolated across the UK, this implies a small decline in the number of smokers, from 8.31 million in 2021 to 8.27 million in 2024, once population growth is accounted for.

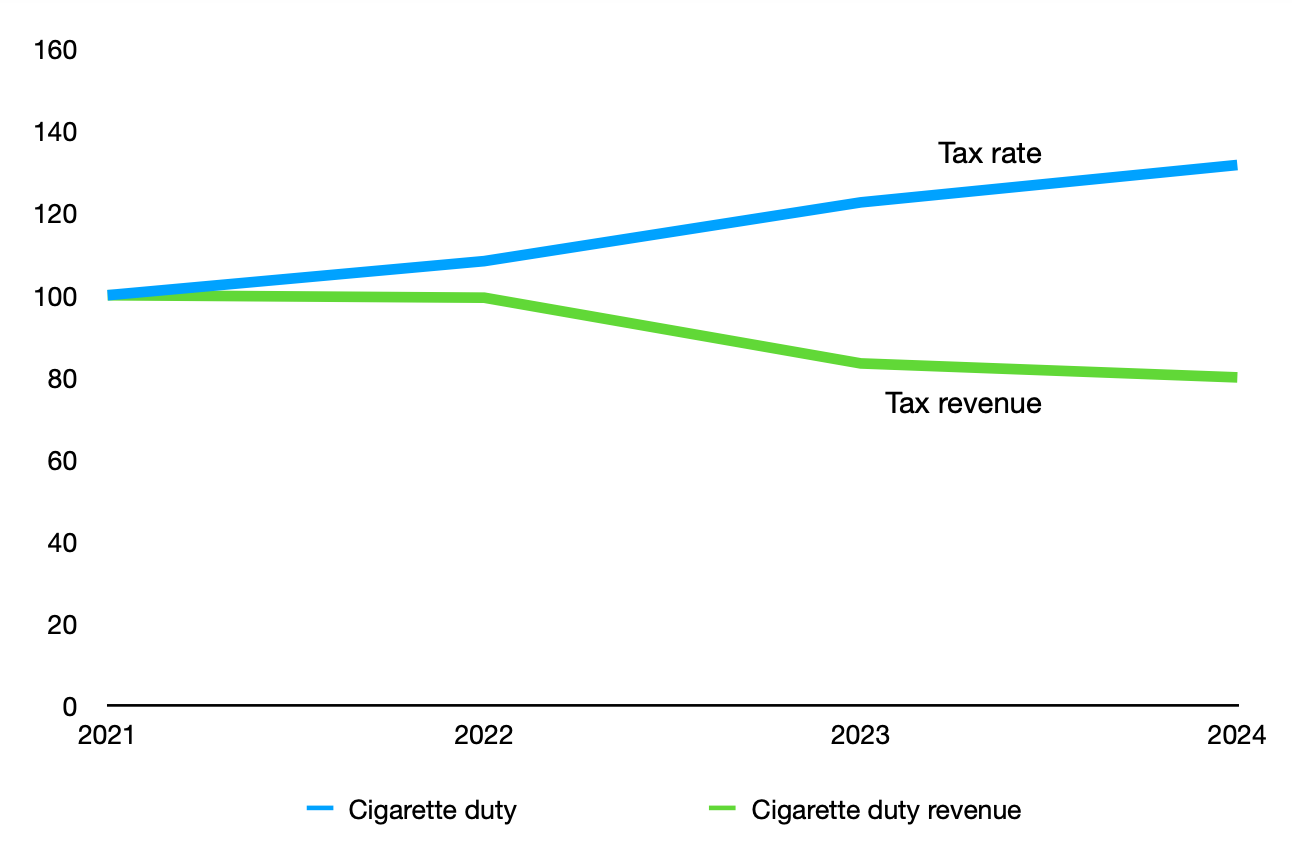

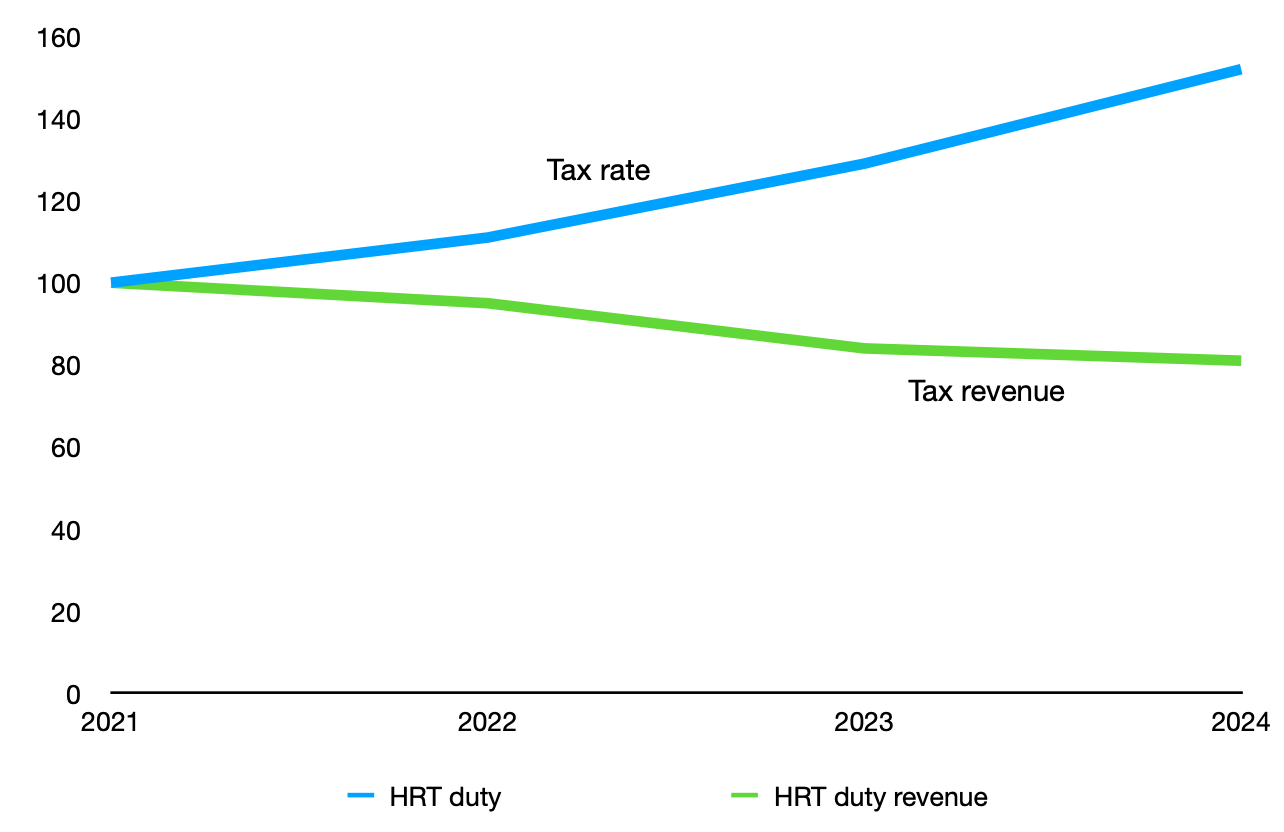

The only plausible explanation for the collapse in legal tobacco sales is that there has been rapid growth in tobacco sales on the black market. There were four significant increases in tobacco duty between October 2021 and October 2024, with the minimum excise tax on cigarettes rising by 39% and duty on HRT rising by 76%. In a classic example of the Laffer Curve, these tax hikes have not led to increased revenue. On the contrary, cigarette duty revenue has fallen by 20% and HRT duty revenue has fallen by 19% (as shown in the two graphs below). Overall, tobacco duty revenue fell from £10.4 billion in 2021 to £8.4 billion in 2024.

These figures should act as a wake up call to the government. Official estimates of the tobacco tax gap lack all credibility. The most recent estimate from HMRC suggests that only 6.9% of cigarette sales were non-duty paid in 2022/23, the lowest figure on record, but HMRC has not had sufficient data to make a plausible estimate since 2019/20 and the government refuses to carry out empty pack surveys.

Anyone familiar with the tobacco market in Britain today will find HMRC’s estimates laughable, but they have been used as a comfort blanket by politicians and campaigners while the Tobacco & Vapes Bill goes through Parliament. The pressure group ASH claims that: ‘The illicit market in the UK has declined consistently since 2000 alongside steadily increasing tobacco taxes.’ It is impossible to square that claim with the evidence presented above. It is not possible to estimate the size of the tobacco black market from the legal sales data alone, but it is clear that the illicit trade in Britain is very large and has grown dramatically since 2021.

Notes on methodology:

As noted above, smoking prevalence data for 2024 is not yet available from the Office for National Statistics. Its Annual Population Survey suggests a larger decline in the smoking rate than reported by the Smoking Toolkit Study and a smaller number of smokers overall. Between 2021 and 2023, it estimated that the number of smokers in the UK fell from 6.6 million to 6.0 million, a decline of 9%. This is larger than the decline of 0.5% reported by the STS between 2021 and 2024, but remains much smaller than the decline in legal tobacco sales of 30% between 2021 and 2023.

2020 and 2021 saw an unusually large amount of HRT sold in the UK (8.6 million kilograms in 2021 compared with 6.5 million kilograms in 2019). This was itself an indication of the scale of Britain’s problem with the illicit tobacco trade since the rise in legal HRT sales reflected the lack of opportunities to travel during the pandemic. This does not explain the huge drop in legal tobacco sales since 2021, however. HRT only comprises around a third of the legal market (in terms of cigarettes smoked) and there has been a 40% fall in HRT sales since 2022 when the market was normalised.

Curious not to mention pipe smoking of home grown tobacco.