Must taxes rise?

Plus: The Bank of England rate cut & Trump's trade policy

In today’s newsletter:

What should the Government do about its £50bn fiscal black hole?

What did the Shadow Monetary Policy Committee say about interest rates?

Trump & Trade

Will nuclear power save the world?

Earlier this week, the National Institute for Economic and Social Research (NIESR) released its latest economic outlook. It suggests the government is on track to break its stability rule – which requires that day-to-day spending be no higher than revenue in 2029/30 – by some £40 billion.

Thanks to higher-than-expected borrowing, lower-than-expected growth, and recent policy reversals, NIESR suggests the government would have to raise taxes by £50 billion (in annualised terms by 2029/30) to restore the previous ‘headroom’ against its fiscal rules.

But hold on a minute. Does the existence of a fiscal gap necessarily mean that taxes have to go up?

I'm not suggesting we relax the fiscal rules so we can just borrow more. There’s nothing particularly sacred about the current rules; previous chancellors have always tinkered with them when they needed to. However, they already provide only a very loose constraint on the government’s fiscal management.

What’s more, Britain has a persistently higher budget deficit (at about 5% of GDP) than most big European economies. Our borrowing costs are the highest in the G7, so piling up more debt isn’t something we should feel comfortable doing.

Yet we should also consider that public spending already stands at 44% of GDP, compared to just under 40% before the pandemic. Surely, there must be some fat to trim? Indeed, spending is going to rise by around £60 billion in real terms by 2029/30 under current plans. Limiting overall spending increases to inflation ought, at the very least, to be possible.

Admittedly, there are complicating factors. About half the planned spending increase is outside the government’s immediate control since it reflects things like debt interest and pensions. And the other half contains the NHS, where massive backlogs, an aging population, and striking medical staff are likely to create significant upward spending pressures.

The upshot is that even a relatively modest goal – don’t let the state grow faster than inflation – requires a degree of radicalism. A return to 2010s-style ‘austerity’ isn't going to cut it. Yet is radicalism in pursuit of lower spending something we can realistically expect from a government that couldn’t even hold a course on winter fuel payments and other minor benefit reforms?

Over on X, I’ve said what I would do if there really were no alternative to higher overall taxes: dramatically broaden the VAT base, compensate lower-income households, implement some pro-growth tax cuts, and still have enough left over to balance the budget. (This would be much less economically damaging than raising income tax or – worse – going after capital and investment.)

This week’s podcast, on the other hand, focuses on the radical reforms that could put us back on a sustainable fiscal footing. We talk about scrapping the triple lock, reforming public sector pensions, introducing deductibles and copayments in a reformed healthcare system, radically overhauling working-age welfare, and getting the government out of the subsidy game altogether. Where there’s a will, there’s a way.

Of course, a lot more detailed thinking is needed. And you can see why a government without a democratic mandate for fundamental reform would baulk at our prescriptions. Nevertheless, as my colleague Steve Davies put it on the podcast, “We have passed the point where you can simply give the house a new coat of paint... you have structural subsidence and you need to do something much more radical.”

Tom Clougherty

Executive Director

The best way to never miss out on IEA work, get access to exclusive content, and support our research and educational programmes is to become a paid IEA Insider.

IEA Podcast: Executive Director Tom Clougherty, Managing Editor Daniel Freeman, and Senior Education Fellow Dr Steve Davies discuss Britain’s looming £50 billion fiscal black hole and what to do about it, the new ‘socio-economic equality’ duty, and the potential impact of AI on white-collar jobs – IEA YouTube

Shadow Monetary Policy Committee votes seven to two to cut Bank Rate

In July 2025, the Shadow Monetary Policy Committee (SMPC) voted to cut the Bank Rate from 4.25% to 4%. The decision was driven by signs of a weakening economy, including rising unemployment and soft retail and manufacturing data, which they felt necessitated a pre-emptive cut to prevent further decline.

Despite a relatively high headline inflation rate, the SMPC was not concerned about a potential inflation surge, citing modest money supply growth and lower oil prices. The vote was a split, with some members favouring a 25-basis-point cut and others a 50-basis-point cut, while two members voted to hold.

For the future, the majority favoured a ‘wait and see’ approach. The committee also debated pausing Quantitative Tightening (QT) due to fragile credit conditions and suggested the Bank of England should consider additional metrics, like money supply growth, when setting policy. Some members stressed that structural issues, not just demand, were contributing to the UK’s economic weakness.

The Government cannot take credit for cuts in interest rates, Economics Fellow Julian Jessop, The Telegraph

The Bank of England’s decision to trim its key interest rate by another quarter point this week was widely expected, but there is still plenty to write about. Unfortunately, little of this is good news.

For a start, why on earth is the Monetary Policy Committee (MPC) still cutting rates when the Bank itself now expects CPI inflation to rise further, peaking at 4 per cent in September? This would be double the MPC’s 2 per cent target, which is meant to be met “at all times”.

News and Views

Reeves ‘vastly underestimated’ scale of private school parents’ VAT rebellion, Executive Director Tom Clougherty was quoted in the Telegraph.

Tom Clougherty, executive director at the Institute of Economic Affairs, said: “It does appear that the Government massively underestimated the behavioural effect of introducing VAT on private school fees.

“Prepayment has clearly been far more significant than the Treasury anticipated when preparing the policy, but I suspect that is just one part of a wider picture. More children have been withdrawn from the independent sector, and more schools have closed, too.”

We Called It: The Online Safety Bill Debacle | IEA Briefing, Public Policy Fellow Matthew Lesh was interviewed by Director of Communications Callum Price, IEA YouTube

Trump’s voters stand to lose the most from his kamikaze trade policies, International Programmes Manager Harrison Griffiths, The Telegraph

Teflon Don strikes again. After concluding his new trade agreement with the European Union last week, many US trading partners will now face sky-high tariffs on their exports. The president’s strongarm tactics and dealmaking have led many on the Right to praise Trump’s approach. Even The New York Times has claimed that Trump is “winning his trade war”.

The economic reality is that Trump isn’t winning anything. He is simply reshaping US trade policy to create a lot of losers: the American people chief among them.

The furious Green Blob will try to destroy these Heathrow plans, Energy Analyst Andy Mayer, The Telegraph

Just expand the damn airport already.

Somewhere in Prime Minister Keir Starmer’s 2026 diary an entry has been written marked “bottle Heathrow decision”. At least that is a reasonable assumption based the current administration’s record with hard choices, and a history of similar cave-ins by governments of all stripes since the 2003 Air Transport White Paper first proposed Heathrow expansion.

Why Nuclear Power Will Save The World | Tim Gregory | Free The Power, Tim Gregory was interviewed by Energy Analyst Andy Mayer, IEA YouTube

Rachel Reeves warned against stealth tax raid on pensioners and workers to fill black hole, Executive Director Tom Clougherty quoted in the Daily Express

Tom Clougherty, of the Institute of Economic Affairs, warned the freeze means “more people end up paying higher rates of tax without becoming any richer in real terms”. He expects it “to continue with no end in sight”.

He added: “But we shouldn’t fool ourselves – this is having a real impact on the spending power of ordinary families.”

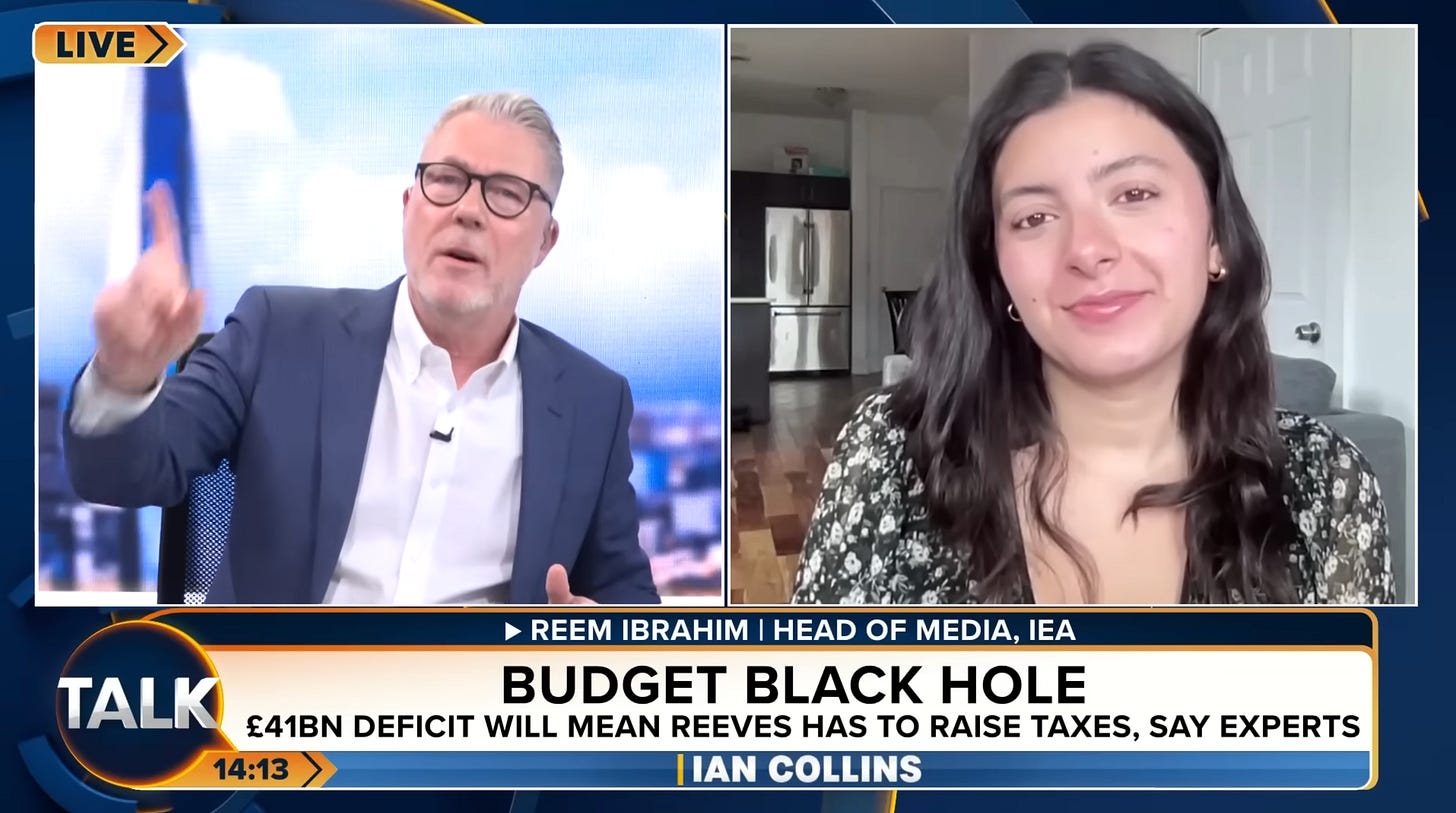

The Budget Black Hole, Head of Media Reem Ibrahim appeared on TalkTV