By Professor Len Shackleton, Editorial and Research Fellow

The state pension is a big issue. It currently costs upwards of £140 billion a year, paid to 13 million pensioners. Both of these numbers are, on current trends, expected to rise; in the case of the former by up to £40 billion in today’s money by 2050.

This is seen as an intolerable burden, particularly by today’s young. They see themselves, hard-pressed with poorly-paying jobs (if they can get one), student loan repayments, high rents and so forth, as subsidising idle mortgage-free retirees on perpetual Saga holidays. A majority apparently believe that they will themselves never receive similar pensions, which will have been scrapped long before they reach their dotage.

More rationally, it is pointed out that the state pension is no longer, if it ever was, paid for by national insurance contributions – which are today just a complicated extension of income tax. The belief amongst today’s retired that they have ‘earned’ their pensions by their contributions is, ruder critics say, a self-serving fallacy. Today’s pensions are always paid by today’s taxpayers (though to be fair that group now includes two-thirds of pensioners). State pensions are really just another form of welfare benefit, and should not be spared from attempts to cut ever-growing state spending.

Of course, we have raised the age at which you are entitled to a state pension. This helps. Now set at 66, SPA is planned to rise further, to 67 by 2028 and 68 in the 2040s. This process could be accelerated, with the pension age pushed still higher if life expectancy rises. There are limits to this as a strategy for containing costs. Older workers have health problems, and even fit workers may find it difficult to get work. Many will have to fall back on other benefits, which may be more generous than the state pension, so reducing the savings to the taxpayer.

One proposal from GenZers in thinktanks and on social media is to means-test the state pension. Well, good luck with that one. As we saw with the attempt to cut back on the relatively trivial winter fuel allowance, there would be tremendous political hostility if any government was bold enough to try it. And, as so often with apparently simple solutions to policy issues, there would be knock-on consequences. Although pensioner poverty is now much less serious an issue than in the past, there are still many pensioners whose overall income is only marginally above the poverty line because they have not been able to save sufficiently during their working (or non-working) life. We need to incentivise young people to make whatever savings they can; means-testing state pensions would have the opposite effect.

Another way to reduce the cost of pensions is to adjust the eligibility criteria. The state pension is not automatic for those reaching 66. Although national insurance contributions don’t pay into a fund for retirement, having made contributions is a necessary criterion for receiving the pension. People are not wilfully confused about NICs: few people understand it. The system is not straightforward.

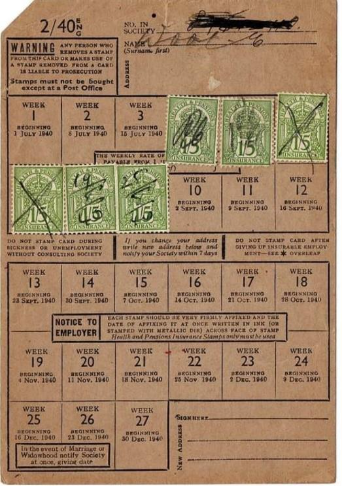

When I was first employed I had a physical card (image below). Each week the employer put a stamp on it to show NICs had been paid. If you lost your job, you ‘got your cards’ to take to the next employer or the Labour Exchange (not ‘Job Centre’ back then). From the mid-70s NICs became computerised, but the principle remained.

These contributions matter. At the moment you need a full 35 years of contributions to receive a full pension; if you have fewer years, your pension is reduced pro rata. You need ten years of contributions to get any pension at all.

Of those who do receive a state pension, about half receive less than the full amount: not a lot of people know this. It suggests a way in which pension spending could be reduced. In the recent past, as a male you needed 44 years of contributions to receive a pension at 65; a woman needed to have paid in for 39 years to get a pension at 60. Even in France, where pensions are payable at 62, you need 43 years in the system to get a full pension. So the 35 years, particularly with a rising SPA, is not a big ask – particularly as there are various credits if you are not working through caring responsibilities, illness and so on.

So we could conceivably phase in a requirement for, say, 40 years of contributions to receive a full pension and fifteen years to get any pension. It wouldn’t affect current pensions in payment, but it would over time reduce the amount paid out. The main sufferers would probably be recent migrants.

The other, more significant, way in which we could control future spending is through changing the basis on which we uprate pensions. A little history on this may help.

Although state pensions date back to the Liberal government of the first years of the twentieth century, the modern pension began with the Beveridge Plan of the 1940s. Beveridge aimed to set the pension at a ‘subsistence minimum’. But, having experienced falling prices in the interwar years, he didn’t plan – and subsequent legislation didn’t allow for – postwar inflation. In practice, until the mid-1970s increases in the state pension were discretionary and unsystematic. In periods of economic downturn, pensioners might experience a fall in real income.

The Labour government of 1974-79 changed this, with a statutory annual increase based on the higher of RPI inflation or the rate of increase of average earnings. The Thatcher government switched to uprating simply in line with inflation. The value of the state pension fell in relation to average earnings as a result, but the average living standards of pensioners rose as a result of an increase in private pensions (still mainly based on final salary at that time), savings and earnings during retirement.

From 1997, the Blair government increased pensions by inflation or 2.5%, whichever was the higher, and then finally the Coalition government introduced the ‘triple lock’; the highest of 2.5%, the increase in average earnings or CPI inflation.

A broad indication of the results of these different uprating methods in shown in the diagram.

The ratchet effect of the triple lock is what worries economists. By 2023/24, the state pension was £300 a year higher than it would have been under the Blair inflation/earnings criterion or £800 a year if the criterion had been a simple inflation uprating. If the triple lock remains, the cost of the pension will keep on rising at an unpredictable rate. The Institute for Fiscal Studies Pensions Review concluded last month that we ought to aim for a specific ratio of pension to average earnings and hold it there, though that would be difficult if inflation rose faster than average earnings as the IFS don’t want to see the real value of the pension ever fall. This would mean that temporarily pensions would rise ahead of average earnings and this would have to be compensated for later by having pensions rise more slowly than earnings. This would be a faff to maintain, would create controversy, and would not save much money, particularly if the desired ratio was set higher than it is currently, as the IFS also wants. Its report was concerned with an optimal pension scheme for the future, with reducing poverty and increasing pensioner living standards rather than simply cutting spending.

A more ruthless approach, focused on cutting back future state spending, would return us to the Thatcher period dispensation. Uprating for inflation only would mean that in principle existing pensioners would be no worse off than they are at the moment, and we would look to encouraging increasing private savings as being the way to raise pensioner incomes in the future. Whether any party has the bottle to go down that route, given the size of the pensioner vote, looks doubtful.

Hi Len! Great piece, clearly put as usual. You put every aspect of choices of cutting our collective liability to our elderly. Saving money for old age will stop that spending during the working life. And reducing pension pay out also reduces spending power in the same way, it takes money out of our tax paying economy. And puts it in the hands of bankers, stock markets and pension funds who make a lot of money from us for playing with our/that money by charging other people interest or charges to pay themselves first. Len it’s a God forsaken maze for sure. Are we not being narrow minded here? Why are we limiting ourselves and our old age to poverty and enjoyment? All that, those cuts do, is to stop money moving. In one fell swoop by taking away from the pension mob the power of spending that money back in the tax paying economy? Not only that what do you suggest they all do with no money? Len, this is a very bad thing to do. The private sector rely now on all that spending from the public sector. They are a symbiotic. One doesent pay for the other, they exist together. I’ve long been of the view that income tax and NIC are one and the same. And I have long held the view that, both taxes are an illusion tax Len. Just because there is income in the heading, doesn’t mean it’s paid by employees! On the contrary, it’s paid by employers!! The worker doesn’t get it to pay it or get it to enjoy or invest before they have to pay it. Self employed people can enjoy it before payment. Indeed they don’t pay it either, another illusion. Their employers pay it within the cost of employment. So it’s always paid by those who employ as the trigger is SPENDING Len. Spending money is the vital double act of any economy. It’s supposed to be a fair exchange of work. But unfortunately we have become used to work exchange not being fair nor is it all exchanged! And there is our problem Len. In assessing fair exchange of money that triggers tax revenue. At present, we have a clear deficit between tax in snd spending out. To give a chive of cutting the cost of governance on the face of it sounds plausible. But what that does is reduce our ability to thrive. We don’t need less SPENDING Len, we need more SPENDING to give us the tax take we need to it’s our way as we all want! We don’t want less pensions we want more Len! A pension is an acceptable way to keep us going in old age. Yes it has to be paid by workers of today. We aren’t savages Len. The fittest survive. We aren’t and should be a caring and thoughtful society. No to cuts. We have underfunded our governments for decades. That’s why we are tripping in potholes and closing schools because the roofs caving in! And yes we have underfunded our pensions. And savings mean you sideline money snd put off enjoying it as a result. We put off SPENDING it too! Leaving it to Bankers and Pension fund managers to enjoy it instead!! What’s that about? That’s a bloody liberty if you ask me. We don’t need private pensions, we just need a bloody good one, a state pension that isn’t half of a minimum wage! Pension schemes are Ponzi schemes anyway. It’s what Bernie Madoff did. Spend other people’s money and enjoy it with a promise of more later. Similar to income tax and Nic. Telling everyone it’s them who pay that tax that are the true taxpayers is wrong and misleading. It’s SPENDING of money via SPENDING on wages that triggers tax not receiving money. It’s money via SPENDING that triggers tax. So business pays income tax and Nic and business is employers and customers, clients and profits. Not employees. Now if you see and accept the trigger of tax, all tax is SPENDING of MONEY and MONEY having to move like Council Tax then surely the ‘growth’ we are all wanting, not for cuts but for proper services and pensions then the answer is not in knee jerk defeatist cuts but in growth gained by increased SPENDING? From increased spending, you have to have more thru put if money. Now the poor, the pensioners and most family’s all SPEND all their money each month anyway. 100% of income they SPEND. So they can’t possibly pay anymore than they already do unless they get more money not less Len. That’s the only way you we they get growth. Move more money in more weight in quicker time. Cutting is going in the wrong direction Len. No what we need is to see that our daily pot from which we trigger tax take is underfunded. It’s devoid of money freely moving via SPENDING with no debt or interest attached. That in turn makes the exchequer devoid of enough tax take and all because there is a pot of our money held outside our daily economy held by the minority of people who hold the majority of our money away snd outside of our economic pot that pays tax! That money is unspent, unused and idle. It contributes nothing to our economy snd triggers no tax revenue. You don’t pay tax on money NOT SPENT, none!! Nada!!! It’s from that pot the government borrow! Our own money!! We have to borrow it back with strings attached. They want it back plus more in interest!!! So they get richer at us getting poorer. We allow it and shouldn’t . It’s unfair and undemocratic Len. It’s not a far snd equitable exchange of work. Now I’m all for earning as much as you can. I’m all for Wayne Rooney getting paid millions to kick a ball. But surely, if he doesn’t SPEND it back how can the system work? Well it’s not Len! It’s not working because people like him who get more than they need to spend , aren’t spending it all back in time for our needs. ( sorry to Wayne you may spend it all) that’s the issue. Not only is money not return or exchanged via spending but they hold it for years on end! We have been borrowing for years. So it’s been going on for years. Why are we borrowing our own money back Len, when the government can change the system and framework so they get more than enough tax revenue! We don’t need cuts or less expectations because those who think we don’t deserve it or we all can’t afford it? We can’t afford it now because we are underfunding the pot that triggers tax!! Not we live beyond our means. We don’t live to our potential means Len. Debate this Len. It’s too easy to cut. Everyone does that. Look around we are crumbling not because we need more cuts. Because we allow vast amounts of the money we all need to be held untaxed and unused outside our working economy.

Would any political party have the bottle to make any changes of the scale necessary? Well, the Thatcher government managed, as you describe, to pare back the updating to inflation only so there is precedent. I wonder if it was in their manifesto or just done once elected; the former might have frightened the horses as Teresa May found when she boldly included in her 2017 manifesto a bold, and necessary, requirement for people to start paying for their own social care in old age rather than leaving an inheritance and saw a huge opinion poll lead evaporate into a failure gain a majority against Corbyn.

An option you don’t suggest that I would advocate is scrapping the state pension altogether for new entrants to the workforce, making it clear that provision for old age is now wholly a personal responsibility. I’d go further and remove the future entitlement for anyone currently under 30 (maybe up to 40?) on the basis that they still have enough time to save, which would have to be compulsory. Obviously there would still be welfare benefits for those in poverty in old age but there should still be huge savings overall. Clearly, this is a very long term solution but it’s a long term problem caused by decades of neglect of the impending time bomb. We have to start somewhere and this seems to me to be one of the least painful approaches as the young famously don’t worry too much about about the distant future.