Many readers will be familiar with the concept of the Bootleggers and Baptists, in which self-interested businesses find common cause with moral busybodies in rigging the market against consumers. The classic example involves alcohol retailers joining forces with temperance activists to restrict licensing laws in neighbouring counties. Bruce Yandle, who coined the term Bootleggers and Baptists in 1983, takes it as a given that ‘guardians of moral high grounds readily mobilise opposition when sin arrives on the political agenda’. Other public choice scholars have described these ‘Baptists’ as ‘public-interest minded’ or ‘puritan reformers’. This puts them outside a conventional rational choice analysis. Their behaviour is assumed to be essentially paternalistic, perhaps even altruistic, and is therefore not self-interested in the narrow sense.

In an article in the Journal of Public Finance and Public Choice, I challenge this assumption insofar as it pertains to modern public health campaigners. The very existence of single-issue pressure groups dedicated to wholly paternalistic action to stop other people consuming tobacco, vapes, alcohol, sugary drinks and certain foods should pose a challenge to public choice economists. Not only have they overcome the free rider problem that deters individuals from joining groups to fight for collective benefits, but they do not appear to have any collective benefits to fight for in the first place. On the face of it, they will not be any better off if they succeed in their campaigns. Given this apparently irrational behaviour, economists have been quick to accept that moral fervour is sufficient explanation. I am not so sure.

One possible explanation for the existence of paternalistic pressure groups is that, if you dig a little deeper, they are fighting for collective benefits. The activists themselves sometimes argue that their political activity is not wholly paternalistic because they are trying to save the NHS money. They argue that smoking, drinking and obesity create external costs that hit the taxpayer. Such claims do not stack up when a full cost-benefit analysis is conducted, but they are nevertheless widely believed and so it is possible that a group of citizens would take collective action against people with bad habits to save themselves money.

But even if the externality claims were true, the financial benefits of suppression would be spread very thinly over the entire population and would be miniscule to the individual. As Mancur Olson famously observed, the costs to the individual of joining or donating to a pressure group aimed at deterring smoking or over-eating would almost certainly exceed the potential reward and even if they did not, the free rider problem would still exist. Olson’s main insight was that people do not take collective action to fight for relatively small gains that are widely dispersed. There is no reason why his theory should not apply here.

A second possible explanation is that paternalistic campaign groups overcome the free rider problem by offering selective incentives to their members, such as price discounts and networking events. This is certainly true of some of the organisations that lobby for lifestyle regulation as a sideline. The British Medical Association (a trade union), the Salvation Army (a religious group) and the Royal College of Physicians (an elite association for medical professionals) offer social and often financial benefits to members which have nothing to do with their lobbying against alcohol, for example. Having attracted resources by other means, they are free to engage in political activity that is not directly related to their core purpose.

But this does not apply to the small, concentrated pressure groups that focus solely on single-issue campaigns. In the UK, the most prominent of these in recent years have been Action on Smoking and Health (ASH), ASH Wales, ASH Scotland, Alcohol Focus Scotland, Scottish Health Action on Alcohol Problems (SHAAP), the Institute of Alcohol Studies, Alcohol Change UK, Obesity Action Scotland, the Children’s Food Campaign and Consensus Action on Salt, Sugar and Health (CASSH) (AKA Action on Sugar). These pressure groups not only fail to offer selective benefits to their members but are not membership organisations at all.

The third possibility is that these groups are essentially philanthropic, i.e. other-regarding, and require no further explanation. In this view, the anti-smoking campaigner is no different from the anti-war demonstrator, and the person who donates to an anti-sugar pressure group is driven by the same incentives as the person who donates to the Royal Society for the Protection of Birds.

There are several reasons to question this. Firstly, coercive paternalism is objectively not altruistic. Unless there is clear evidence of market failure, economists assume that people satisfy their preferences and optimise their wellbeing. Anything that stands between them and their small pleasures imposes a cost on them and makes them less happy. This is hardly altruistic. Admittedly, paternalists may not share the assumptions of economists, but the general public does not seem to be view coercive paternalism as altruistic either. The British donate large sums of money to such causes as animal welfare and disaster relief, but they almost never donate to paternalistic pressure groups and there is virtually no voluntary activism against drinking, vaping, gambling and so on.

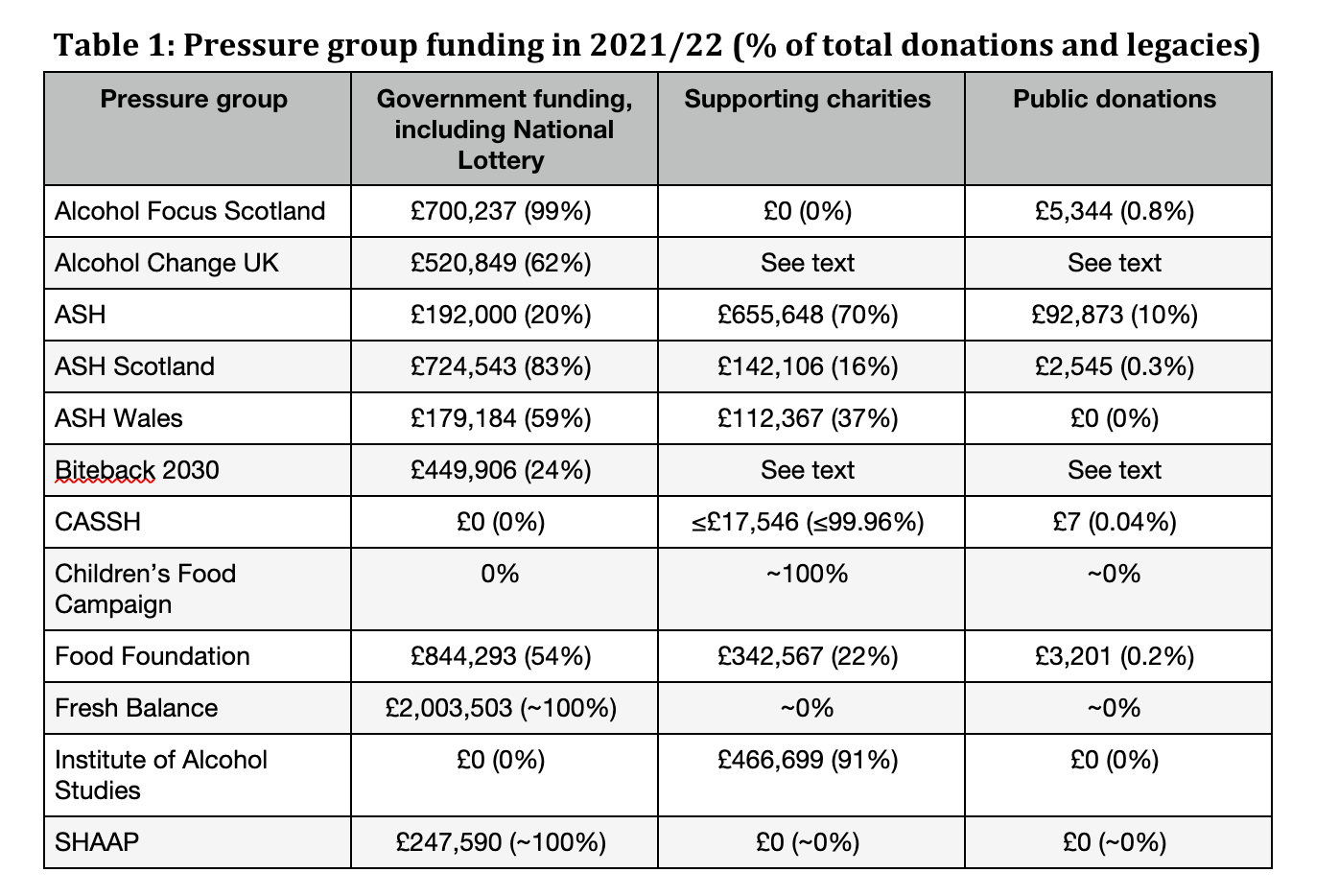

Finally, altruism by definition requires selflessness. If an individual benefits from an action, it is not altruistic. But the UK’s single-issue public health pressure groups consist of a very small number of people who are fully remunerated for their work. As shown in the table below, they do not depend on donations from the public but from elite sources, mostly the government. Most of the groups in the table receive less than 1% of their income from the public. There is no need for them to offer selective incentives because they only have a small number of employees who are financially incentivised by their salaries. They bypass the free rider problem by having no members and by acquiring their resources from a tiny number of state and third sector actors. I discuss in the paper the reasons why the government, a few large charities and the occasional super-rich donor give money to these groups, but the important point is that these groups would probably not exist without this funding and the ‘activists’ are being paid for their activism. They are, in short, acting in their narrow economic self-interest.

One implication of this kind of professionalised, state-funded activism is that it creates a permanent imbalance in the political ecosystem. As Olson argued, vociferous minorities can prevail over unorganised majorities so long as they have the resources and incentives to do so. Consumers do not mobilise to defend their collective interests for the reasons Olson explained. It is well known that the demands of pressure groups can become increasingly extreme over time (‘mission creep’), but this becomes almost inevitable when people are being paid to campaign. The big difference between the single-issue pressure groups described above and the typical public or private interest group is that the former exists only to campaign for new policies. It almost does’t matter what the policies are.

Society in general may be content with a new equilibrium, but a permanent settlement is an existential threat to the professional pressure group. So long as they are given the resources, they will continue to find new dragons to slay. Indeed, they must find new dragons to slay if they are to continue attracting resources. Permanent disequilibrium is built into the business model.

Taken to its logical conclusion, this would lead to lifestyle regulation in the name of public health becoming a one-way ratchet that leads to increasingly draconian measures being enacted. Further research in other countries is needed to see whether this theory of paternalistic collective action is generalisable, but it could certainly explain what has been happening in Britain in recent decades.

It’s an interesting correlation that certainly needs to be aired. Just this week we see Labour reversing its decision on winter fuel payments quoting its as a result of their economic choices working so they can re introduce it! Whereas we can all see it’s as a result of pressure from a minority and a need to combat their fight with Farage over possible lost votes! Again a minority. Labour are not reasonable to use their defence when it’s more likely to be the later. But this ‘two faced’ approach by minority groups such as ‘just stop oil’ and anti obesity are deluded in their basic stand point as their opinion is flawed and their view ideology misplaced. Let’s take just stop oil! To think they can make the majority stop using oil is so deluded it’s ridiculous. Everything we have in life relies on oil or its chemical offshoots. I witnessed a doctor in NHS arguing for it on TV wearing a polyester coat and rubber gloves plastic pens and spatulas and a man made visor and mask. I bet he got to work by car or train and is willing to receive money for his job! It’s a stupid and diabolical intrusion into our normal lives to push such balderdash! And let’s look at anti obesity arguments? Fat people are not always fat because of over eating! Metabolism problems, disabilities and being poor are all factors to be wise of. The NHS is for all citizens. Black white yellow or brown! Fat thin tall or short. Not every patient is obese. And would you call pregnant women obese? I bet they are all thin! And let’s face it probably go to the gym! But they too will need the NHS when they break a limb or have a heart attack at 50! And then let’s look at who pays for the NhS? Everybody does! The people who think they have right on their side assume they pay for others who don’t deserve their money! Well let’s just look at tax. PAYE employees do not pay income tax! Their employers do! Also self employed pay income tax and charge their employers for it! So it’s employers who pay it not employees! It’s just calculated on wages!! And while the thin pay got their gym membership the fat one is buying curry or McDonald’s and paying vat! Indeed vat and duty paid by those who spend all their money each month on food pay in more tax than those who work and run and don’t spend all their money each month. Pro rata a disabled obese person pay 100% on their income whereas a rich thin man who spends a quarter of their income contributes only 25% towards tax! So the obese pay in more by default! Income tax is about a quarter of tax income. Vat and duty revenue is more something like a third! So working paying income tax ( so they think) and spending little because of lifestyle probably contribute less in tax take pro rata than a fat disabled who is unemployed but spends all their money each month on stuff that pays vat or duty! So I believe they have gone too far! If people want to smoke or drink themselves into the NHS then they too pay so much more in tax to pay for their care! They contribute more so the NHS is there when a skinny person falls through a grate and needs a bed! We all pay working or unemployed. I hate hearing ‘we the taxpayer’ the ones who point their finger quoting that are probably the ones who pay the least in tax! As tax is not triggered or paid on money unspent and unused! It’s the obese and disabled and the unemployed and the unemployable who pay the most in tax pro rata as they spend all their money each month and are the majority of people! The minority are the ones shouting ‘we the taxpayer’ as they get the most but don’t spend it back to pay their full tax burden! Tax is triggered by spending. Don’t spend you don’t pay tax! So you don’t contribute ! It’s a misleading and misunderstood standpoint and we take it as gospel! Well I don’t! I worry when any pressure group is money led! We never really know why they do what they do. Alternative reasons may be in play! A smoker like a drinker like an obese person pay more into the nhs than a thin runner for a deluded just stop oil parasite. Let’s get the facts right!!! Know how tax is triggered snd never assume you pay in more than another. Let’s look at a homeless tramp beggar! Who is comatose on the village green bench as a result of consuming a bottle of whisky purchased as a result of begging! He had just paid 73% in vat and duty, let alone profit and income tax for the wine merchant, on that bottle of whisky and he had spent all his income! That nearly double a higher rate income tax payer who may not have spent their income that month and contributed nothing to our take take! Nothing! So never assume you pay or contribute more, the government pay little to counter the tax take they gave in such things that make us ill!

I came to this conclusion when I was Chairman of Grants for Ealing Council in 1991. We were funding a second social services but unaccountable to professional officers. I insisted on seeing evidence of unpaid local volunteers (that would mean their organisation had public support), withheld grants if monies in the savings account were over £40k or so and stopped grants if they were part of a nationwide organisation like Age Concern, Mind etc. which was not what our policy for helping local organisation like the cine and film club, choirs, etc was.