Another Tax Grab?

Plus: Labour market woes & free speech under threat

In today’s newsletter:

If tax hikes are inevitable, what is the least painful option?

The latest labour market statistics

The death of British prosperity

Does the UK have a free speech problem?

Tax should be a level playing field, not penalise wealth creation.

At last, some better economic news. UK GDP grew 0.3% in the second quarter of the year, much slower than the 0.7% in the first but still beating expectations.

New data on monthly GDP also suggest that the economy has begun to shrug off the increases in taxes and other business costs that landed in April. The hit to GDP in April was revised to a fall of ‘just’ 0.1%, and there was a 0.4% bounce in June.

It might be tempting to conclude that the Autumn Budget will not have to be as punishing. But that would be wishful thinking.

For a start, the expenditure breakdown of the GDP figures was worrying. Growth was led by higher public sector spending and stockbuilding, with household spending and business investment both weakening sharply.

Moreover, there are already signs that any positive momentum in the private sector is fading. Business and consumer confidence is stuttering again as inflation rises and as more tax increases loom.

These fears are understandable. Headlines suggesting that the ‘black hole’ may be as large as £50 billion are based on growth forecasts which look too pessimistic. But the gap to be filled could easily be £25 billion.

Of course, the best way to balance the books would be to cut spending and do more to boost growth via supply-side reform. Realistically, though, taxes will be raised further.

There are two ways in which this could be done while minimising the harm to the economy.

One would be to broaden the base of existing taxes on income and spending. This could include raising the upper age limit on paying National Insurance and extending VAT to all goods and services, including food and children’s clothing. Exceptions could still be made for spending which is best seen as ‘investment’, notably on education and healthcare. But these reforms would be politically difficult, to say the least.

The other would be to do more to ensure that income from capital is taxed in the same way as income from labour, creating a level playing field. But again, this should mainly be about closing loopholes, rather than increasing the main rates of tax.

For example, the fact that companies have already paid tax on profits would still justify a lower rate of tax when these profits are paid out in dividends, or when they are reflected in capital gains on shares.

A similar ‘double taxation’ argument applies to Inheritance Tax (IHT). This tax is already bad enough, because it amounts to an additional charge on wealth creation which happens to benefit future generations.

But it is also being suggested that the Chancellor will double down on this problem by reducing the value of lifetime gifts which are exempt from IHT. This would mean that parents would save even more tax by spending the money themselves rather than passing it on their children. That surely makes no sense at all.

Julian Jessop

Economics Fellow

The best way to never miss out on IEA work, get access to exclusive content, and support our research and educational programmes is to become a paid IEA Insider.

IEA Podcast: Director of Communications Callum Price is joined by Editorial Director Kristian Niemietz and Managing Editor Daniel Freeman, the conversation covers the heated debate around Fraser Nelson's Times article on crime, economic policy constraints, threats to freedom of expression – IEA YouTube

'Little scope for optimism' in jobs data

Professor Len Shackleton, Editorial and Research Fellow at the Institute of Economic Affairs, said:

"Today's labour market data continue to suggest a gradually worsening picture. Payroll employment is down a little more, while vacancies are at their lowest level in the best part of a decade. The unemployment rate has crept up to 4.7% while the rate of increase of earnings has dropped.

"The figures are always a mishmash. Payroll figures for employment and claimant count figures from the DWP are pretty reliable. Vacancy data from a survey of employers have a significant margin of error. LFS data for self-employment are lagged estimates based on a household survey which has suffered severe response problems in recent years and even now needs to be taken with a pinch of salt. The unemployment level and rates are again based on the dodgy LFS. So there are as always some apparent anomalies in the overall picture.

"Nevertheless, it is clear there is little scope for optimism in the figures, bearing in mind the pressures which employers are under from the big hike in minimum wages and the rise in employer NICs, still working their way through. Anecdotally, many people who leave jobs are not being replaced as employers seek to reduce payroll while avoiding the costs associated with making people redundant. Many employers are also apprehensive about the implications of the Employment Rights Bill, which will soon reduce businesses’ flexibility in reacting to market fluctuations and raise their costs in various ways."

News and Views

Kemi Badenoch warns Keir Starmer over income tax raid to fill £51bn blackhole, Executive Director Tom Clougherty quoted in The Daily Express

Tom Clougherty, executive director at the Institute of Economic Affairs, agreed with Mrs Badenoch the “focus should be on spending cuts rather than tax increases”.

He said: “Public spending is already 44% of GDP. It is set to rise by about £60billion in real terms by 2029-30.

“The most sensible focus would be on keeping public spending flat in real terms over the next few years, while pursuing regulatory reforms that will increase economic growth. Ideally this would not be a rerun of 2010s ‘austerity’.

“We need a different, more radical approach – with the Government fundamentally rethinking what it does and how it does it, so that the public finances can be put on a sustainable long-term footing.”

Prohibiting pints instead of doing politics, Head of Lifestyle Economics Chris Snowdon, The Critic

The British public are angry. They feel let down by successive governments. There is a palpable sense of decline. Tired of broken promises, voters are turning towards populism. Tension hangs in the air. Bad vibes.

Sensing the public mood, Sir Keir Starmer has grasped the nettle. A man of action with an uncanny, almost telepathic, ability to get inside the mind of the ordinary Joe, he has announced plans to consult on reducing the drink-drive limit and giving motorists points on their driving licence for not wearing a seat belt.

The Death of British Prosperity: What Went Wrong? | IEA Live, Editorial Director Dr Kristian Niemietz, Education Fellow Dr Steve Davies, Economics Fellow Julian Jessop, and Law and Economics Fellow Cento Veljanovski, IEA YouTube

Why broadening the VAT base might be the least bad tax?, Executive Director Tom Clougherty writes for The Times

Spending cuts are neither impossible nor impractical. Current plans suggest that annual government spending in the 2029-30 tax year will be about £60 billion higher in real terms than it is now. Limiting the overall increase to inflation over the next few years would solve the problem… Britain’s VAT base is exceptionally narrow by international standards. Broadening it could raise huge amounts of revenue while also simplifying the tax system and removing some of the economic distortions it creates.

CMA’s Google crackdown will put the UK’s AI revolution on hold, Public Policy Fellow Matthew Lesh, CityAM

“One Billion Customers – Can Anyone Catch the Cell Phone King?” ran the cover story in Forbes magazine. But this wasn’t about Apple, or even Android. The headline captured Nokia’s heyday in November 2007. Just a few months earlier, Apple announced the iPhone, and the following year, Google would release Android. Nokia’s supposedly unassailable monopoly would rapidly evaporate.

Force drivers over 70 to take eye test? Feat. Reem Ibrahim & Henry Bonsu | Jeremy Vine, Head of Media Reem Ibrahim appeared on the Jeremy Vine Show on Channel 5

Britain's Energy Market U-Turn | Free the Power, Energy Analyst Andy Mayer interviews Nicholas Leighton-Hall, IEA YouTube

Calls to scrap Over-60s free travel after 'lost revenue for TfL soars to £84 million in a year', Head of Media Reem Ibrahim, The Standard

Reem Ibrahim of the Institute for Economic Affairs told the LDRS: "It's absurd that Transport for London continues to give blanket travel discounts to everyone over 60, regardless of income, at a cost of £84million last year.

“This is not targeted support to those that are most in need. It disproportionately benefits the wealthiest demographic."

Over-60s hold £2.89trillion of mortgage-free property, and 25% of all pensioners are millionaires. When TfL is facing a funding gap, and taxpayers are footing the bill, it is entirely unjustifiable to subsidise free travel for those who can readily afford to pay."

The Government cannot take credit for cuts in interest rates, Economics Fellow Julian Jessop writes in the Telegraph

The Bank of England’s decision to trim its key interest rate by another quarter point this week was widely expected, but there is still plenty to write about. Unfortunately, little of this is good news.

For a start, why on earth is the Monetary Policy Committee (MPC) still cutting rates when the Bank itself now expects CPI inflation to rise further, peaking at 4 per cent in September? This would be double the MPC’s 2 per cent target, which is meant to be met “at all times”.

Does the UK have a free speech problem?, Director of Communications Callum Price appeared on Times Radio

Reeves ‘vastly underestimated’ scale of private school parents’ VAT rebellion, Executive Director Tom Clougherty was quoted in the Telegraph

Tom Clougherty, executive director at the Institute of Economic Affairs, said: “It does appear that the Government massively underestimated the behavioural effect of introducing VAT on private school fees.

“Prepayment has clearly been far more significant than the Treasury anticipated when preparing the policy, but I suspect that is just one part of a wider picture. More children have been withdrawn from the independent sector, and more schools have closed, too.”

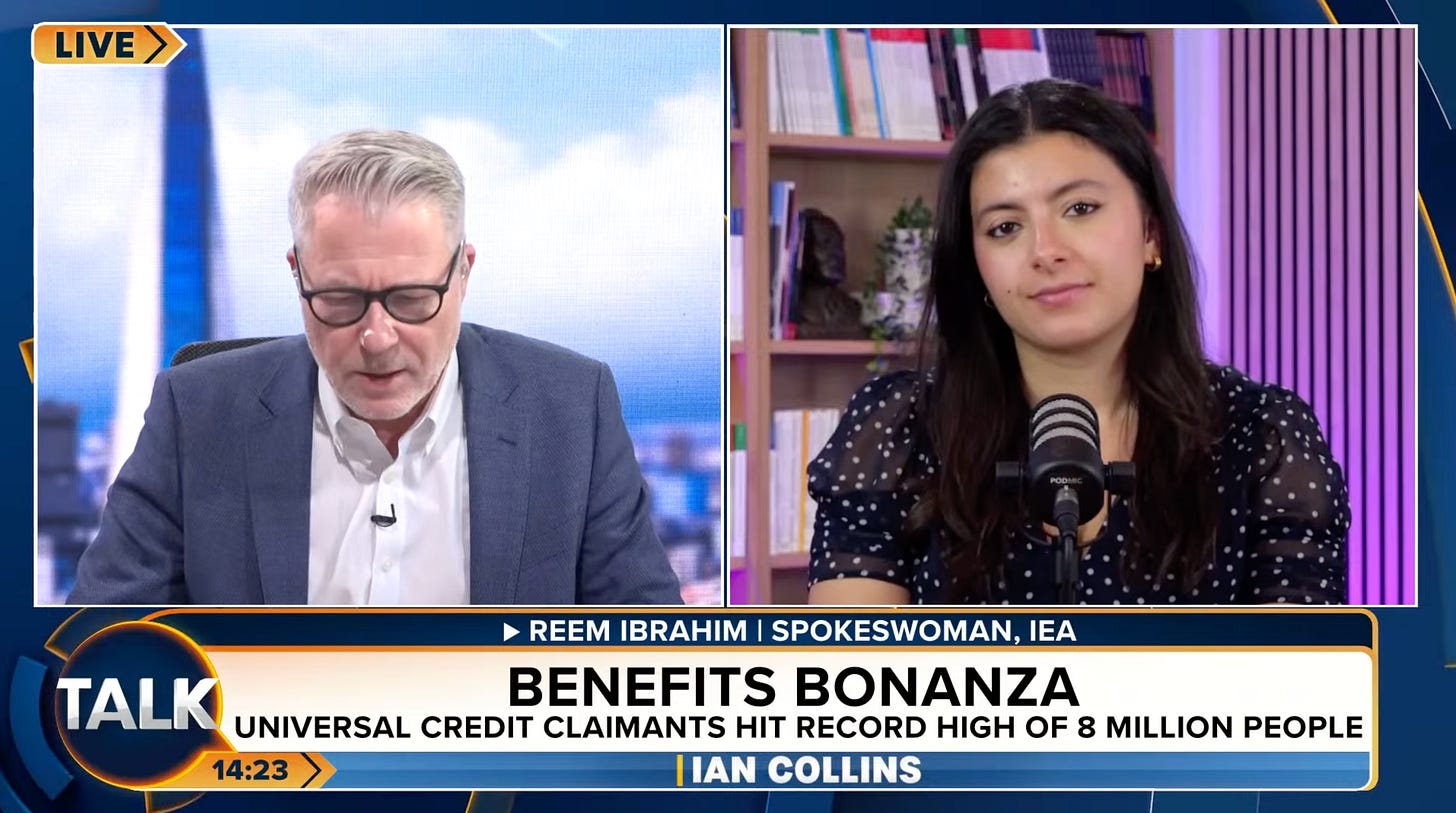

How is there 8 million people on Universal Credit?, Head of Media Reem Ibrahim appeared on TalkTV

Andrew Neil points out fatal flaw in Rachel Reeves’ economic pledge as growth stalls, Economics Fellow Julian Jessop quoted in the Express

The Institute of Economic Affairs said that while today’s release may relieve tensions of an imminent recession, “growth is still too weak to fix the public finances, or encourage hiring and investment, and there are already signs that the positive momentum is fading again.”

“There are already signs that consumer and business confidence are stuttering again as inflation picks up further and as another punishing Budget looms in the Autumn.

"The near-term prospects for the economy are still grim. As ever, more state intervention, more public spending, more borrowing, and even more taxation cannot lay the foundations for sustainable growth."

Economic woes?, Head of Media Reem Ibrahim appeared on TalkTV

Fresh tax grab?, Head of Media Reem Ibrahim appeared on GB News

Does the UK have a free speech problem?, Head of Media Reem Ibrahim appeared on BBC 5Live

Media Exploits Children to Push Gun Control, Head of Media Reem Ibrahim appeared on The Reason Roundtable

A Free-Market Fix for Student Debt, Head of Media Reem Ibrahim appeared on the bonus episode of The Reason Roundtable

Julian, do you honestly believe that tinkering around with tax hikes or spending cuts or taking in one hand and giving in the other is the answer? We are nearly £3,000,000,000,000.00 trillion pounds in debt… and counting. We haven’t covered the cost of government in 25 years. We are now borrowing to pay back interest, so the writing is on the wall. THIS MONETARY SYSTEM DOES NOT WORK!… and what is our monetary system? It’s a system that bases government tax revenue on the SPENDING of MONEY in our pot. Our working and daily pot, is supposed to give us enough money to pay our way and supply a tax take to cover the costs of government. … it doesn’t work!!!!!… it never has and never will. Why?… because the pot that we all pay each other and pays tax is not big enough! Why? Because, most of our money is not in our pot because, it’s held elsewhere! Abroad in bank accounts anywhere but here. We are devoid of all that money. They say 95% of money is held by the top 5% of rich. So that means 95% of us in the UK are fighting over just 5% of our money! And when we are short of it we borrow our own money back again to cover the deficit. And guess what? We have to pay them back plus interest! So, they get richer while we get poorer. So Julian, it’s got did all to do with raising more here or cut a bit there. It’s got everything to do with us, the goose that lays the golden egg of tax revenue. We don’t have enough in the system to create the tax required by the Chancellor! How many times are you all going to pick up a broken clock and adjust the hands before you all realise it’s BROKEN! We need a real solution, not more different of the same old tinkering! Decades of economists can’t make head not tail of this system and none of you come up with a solution except for more cuts or more taxes or more borrowing. You have no more of a clue than Rachel Reeves. And you keep picking it up and looking at it from different angles and go to statistics to tell you that it’s kAPUT and still you try and make 2+2=7. It will never equal 7. It’s 4 we want! I’m trying very hard here to make a case that you are completely missing the point! If you allow 95% of our money to sit outside our pot, unspent and unused, banked, idle and hoarded then how can you expect us to provide enough tax revenue to pay our way snd the governments? What part of that simple and clear explanation don’t you get? The system doesn’t allow for the return of money to our pot via SPENDING so we can all pay our way? We need a SPENDING policy to make all our money come back. To give us the tsunami of tax revenue that will have the coffers of the exchequer overflowing again! What other way can we start to pay our way, pay back the debt and interest, all without any further borrowing?? You tell me Julian. It doesn’t take much brains to see we can’t make enough? You all tell us that growth is the answer! No!! It’s more tax take that needs to happen. That only happens when SPENDING occurs in the pot of our people, snd unless you look snd see its devoid of all its money, if you can’t see that clearly then I’m afraid we have no hope. It’s not money we are short of, there’s about £18-19 trillion pounds out there. But it’s not in our pot on a daily or monthly basis. That’s the reason we’re in the crapper! The rich are holding it out of reach. Snd we allow it! Will someone at IEA start debating this, so we can stop talking claptrap that won’t work and start discussing a pathway that will.